We’ve all been there, you’ve finally found that bottle that has eluded you for so long. Your palms are sweaty, eyes tired from staring at a computer screen for hours, face plastered with a stupid smug smile, complete and total joy is overcoming you at an alarming rate, SUCCESS you think, until you go to the checkout and realize the company is in the USA and does not ship to Ireland.

Shipping Alcohol in good ole USA is not as easy and as straightforward as you think. Make it over that hurdle and get the bottle to our shores, you have to deal with customs, excise, and VAT. In this first part of a two-part series I break down some of the issues behind laws in the states and demystify our customs and import Charges.

GOOD OLE UNCLE SAM

Firstly, here is what you need to know and understand about the shipping laws in the united states when it comes to alcohol.

IT IS DIFFICULT, CONFUSING, VARIED & COMPLEX.

Many of the state’s alcohol laws were written after the 21st amendment repealed prohibition in the 1930s, and that included their shipping laws. The amendment left shipping regulations up to individual states, who all came up with their own laws. To sum up – you are basically dealing with 50 different countries with different laws on shipping.

In Brief, the states has a 3 tier system, which means distilleries can’t sell to individuals they have to go through wholesalers, wholesalers cant sell to individuals they have to go through retailers. Depending on the states shipping laws the retailers may then, if properly licensed and within state regulations, ship to you a lovely new bottle of your favourite.

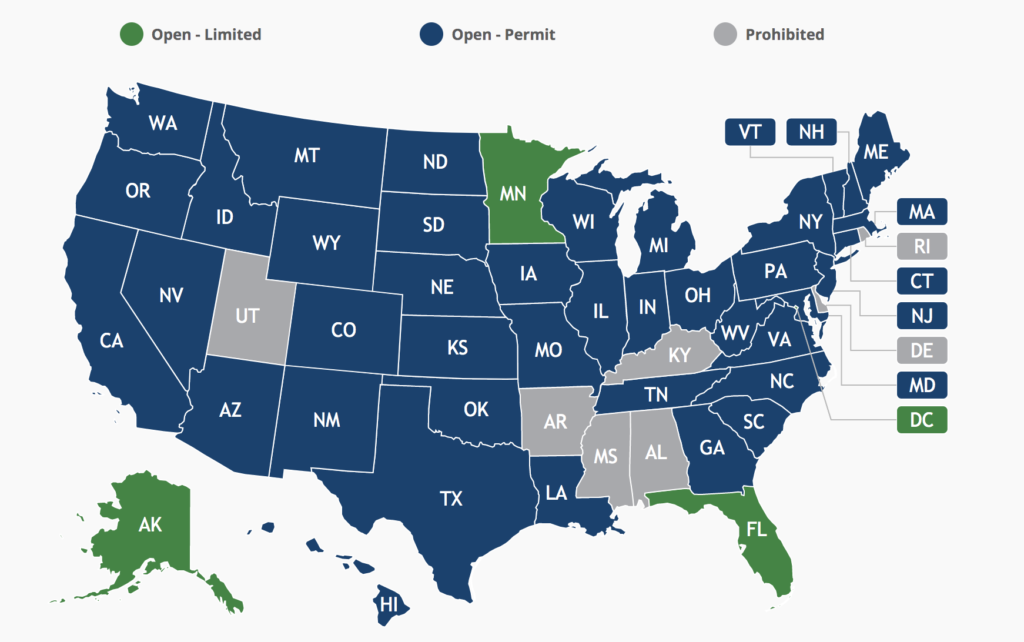

It is generally not allowed for a non- licensed individual to send to another individual, or anyone else within the U.S., alcohol. Keep this in mind when buying alcohol from the U.S. with the intention of shipping it to Ireland. Below is a chart graphing the different states and whether or not permits are required by businesses for shipping or if alcohol shipment is prohibited completely. If you’d like to know more then click HERE for a fully comprehensive breakdown of alcohol shipping laws per state. Brace yourselves, it’s a big read….

DISCLAIMER: American laws around shipping changes constantly, therefore the information supplied may change without notice.

KNOW THE FACTS – EXCISE & TAX

Understand this, you are going to get caught for excise, customs, and VAT ( tax ) at some point. Customs have become remarkably good at sniffing out packages containing alcohol. Knowing correctly how to calculate how much this will cost may help you come to a determination on whether or not its worth shipping home that bottle.

Here is a breakdown of what revenue will charge you before your package is released from your carrier/service provider. Please note this does not include your carriers service charge, which varies anywhere from €10 minimum to up to 5% of the goods worth.

EXCISE DUTY

Currently, the excise on 1 Litre of alcohol costs €42.57, and generally speaking most bottles from America are 75cl ( 750ml ). Let’s say that your 75cl bottle of whiskey has an ABV of 46%, you can work out the excise owed by the following formula:

size of bottle in ml x .alcohol percentage = total ml of alcohol in bottle

So , for the above scenario we have:

750ml x .46 = 345ml of pure alcohol

We then take the ml of alcohol and multiply it by the total excise per litre ( €42.57 ),

.345ml x €42.57 = €14.68 Excise Duty to be paid.

CUSTOMS IMPORT DUTY

As the name suggests, an import duty is also calculated when the bottle shipped in from the U.S. You didnt just think you had excise to pay, did you?

Customs import duty varies between countries around the world. As anyone knows when you buy a bottle of alcohol within the European Union you do not have to pay a customs import duty when it arrives in Ireland. Perks of the EU’s single market trade agreement. However, if importing Whiskey ( Specifically ) from America then you can look forward to paying 25% on the value of the bottle of whiskey.

If a bottle of whiskey cost ( in euro and without shipping costs ) €100, then your import duty costs €100 x .25 = €25

VAT ( VALUE ADDED TAX )

And just when you thought it was all over, you get charged VAT. As if things weren’t bad enough. But I hear you ask ” didn’t we just pay tax with excise “? Yes, well kind of. In the technical breakdown of it here you are taxing a tax. So you’re being taxed twice, on import alone, Basically. On the above info lets work out the VAT owed and we can finally see the true cost of importing alcohol from the USA. The current rate of VAT in Ireland on goods and services is 23%.

EXCISE ON ABOVE = €14.68

IMPORT DUTY = €25

BOTTLE VALUE = €100

BOTTLE VALUE + IMPORT DUTY + EXCISE = 139.68

VAT AT 23% of €139.68 = €32.12

Grand total then is – EXCISE + IMPORT DUTY + VAT

GRAND TOTAL OWED TO REVENUE = €71.80

That my friends is Revenue for you!

The final figure above is also not taking into account the supplier’s shipping fees ( plus VAT ), handling fees, and other charges that may eventually be added on. So you see how quickly this can add up and how expensive it can be to get your package in from the states, Keep in mind, of course, you have already paid for the bottle and shipping within the United States! Before your next purchase you need to ask yourselves, is it worth it?

FINALLY

For the collector and hardcore whiskey enthusiast/drinker, you need to make a decision on whether or not the bottle is worth that extra cost. In part 2 of the series, I’ll look at how to overcome getting the bottles across the pond, possible workarounds, and legal ways of getting your whiskey home, safe. Be sure to subscribe to the blog for part 2 and bookmark this page for future reference, until next time, Sláinte.

0 Comments